|

OpenPDM integrates the new PLM landscape at WebastoBy Mirko Theiß The Webasto Group has ambitious plans: The global innovative systems partner to almost all automobile manufacturers is not only migrating its CATIA installation to the 3D Experience platform, but is also replacing its heterogeneous PDM landscape with a uniform company-wide PLM platform. As an integration platform, OpenPDM provides an easy to maintain connection between 3DExperience and the SAP-based PLM solution 4PEP from ILC.

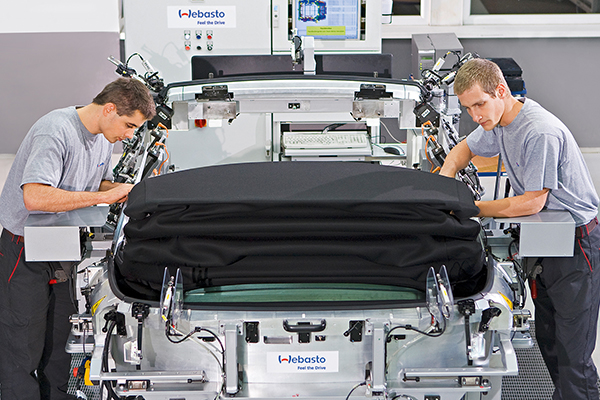

Being among the top 100 suppliers to the automotive industry, Webasto generated sales of 3.4 billion euros and had more than 13,000 employees at over 50 locations (with 30 of these being manufacturing plants) during financial year 2018. The core business comprises a wide range of products for vehicle manufacturers: sunroofs, panorama roofs and convertible roofs, heating systems for cars and commercial vehicles with all types of drive systems, together with battery systems and charging solutions for hybrid and electric vehicles. Webasto moreover has a strong market position in the aftermarket business and provides dealers and consumers with customized solutions and services for thermo management and e-mobility. In the last ten years Webasto has also grown strongly through company takeovers. Important milestones were the acquisition of the convertible division of Edscha, the North American business of Karmann, the Diavia air conditioning business of Delphi Italia and the Efficient Energy Systems (EES) business of AeroVironment, which today manufactures charging solutions under the name Webasto Charging Systems Inc. In addition, the company has recently bought the shares of its long-standing South Korean joint venture partner. The joint venture Webasto Donghee, with headquarters in Ulsan (South Korea) that previously focused on production and sales of panorama roofs, is now part of Webasto's worldwide development and production network, thus strengthening its position in Asia further. Heterogeneous PDM landscape One consequence of the takeovers is that the company today has a heterogeneous PDM system landscape. The roof and thermal systems division uses PTC Windchill, the convertible division SAP PLM, Webasto Charging Systems Inc. Oracle Agile PLM and the former South Korean joint venture, the Teamcenter software from Siemens PLM. The development and change processes of the various divisions are not uniform either, which makes it more difficult to handle global development and production projects. Particularly in the field of roof systems, Webasto faces the challenge of developing products for global customers and manufacturing them at various locations. "Whereas we used to develop roof systems for a specific vehicle, we now offer our customers platforms that can be installed in several vehicle types or brands of an automobile manufacturer with certain adaptations," explains Jorge Ortiz, who is responsible for user training in the central PLM project team. This saves development costs, but also means that every change must be coordinated with all development departments involved. Another challenge is that Webasto is becoming a mechatronic focused company that develops and manufactures its own software and electronic components. The basis for this was laid, among other things, by the takeover of the electronics service provider Schaidt Innovations. This necessarily requires a closer connection of software development to the product development process and the IT systems supporting it. The Webasto strategy is therefore to establish a uniform organization and implement a globally uniform product development process for all divisions, which can be mapped in a uniform system environment. This process will also support Model-Based Systems Engineering (MBSE) in the future, as Ortiz explains: "We want to create a CAD/PLM development environment with uniform data structures and enable users to access data quickly and easily via a single point of truth, regardless of their location and region. Approach to production When selecting the new PLM solution, Webasto was faced with the alternative of either looking for greater proximity to the CAD landscape with CATIA V5 and Dassault Systèmes' 3D experience platform as the target system, or approaching the SAP ERP system. None of the existing PDM systems met the requirements of an enterprise-wide PLM platform. In the case of Windchill, it was an older version that was gradually being phased out of maintenance and with which users were no longer satisfied with the usability.

4PEP is an industry-specific PLM solution with preconfigured processes and methods optimized for the supply industry. Among other things, it offers modules for product structure and variant management, configuration and change management, master data management, but also for requirements management, project control and cost management. Webasto thus simplifies variant handling, for example, by no longer defining color variants of roof systems during development, but only during production coordination, explains Ansgar Villis, Deputy Managing Director of ILC GmbH and project manager in the Webasto project. Cooperation with PROSTEP The partnership with PROSTEP was very helpful in winning and carrying out the demanding PLM project, as Villis continues. The company is a recognized integration specialist with a wealth of industry experience, process know-how and technological expertise, as well as strategic partnerships with leading CAx and PLM manufacturers, Ortiz confirms. Based on the OpenPDM integration platform, the company has developed standardized connectors for 3DExperience and 4PEP, which can be quickly adapted to customer-specific requirements. Based on PROSTEP technology, Webasto also intends to integrate the Rational RTC software, which is used in the electronics sector for configuration and software management. In close cooperation with ILC, PROSTEP implemented the data mapping for the various integration cases - starting with the transfer of design orders to the 3D Experience platform. During the pre-delivery of development stages for the procurement process, models and drawings are then converted into the neutral formats JT and 3D PDF, transferred to 4PEP and stamped with the note that they may only be used for requests. Once the design is complete, OpenPDM triggers a complex approval workflow in 4PEP that integrates purchasing, manufacturing, costing and controlling. If everyone approves the release, the integration platform reports the status change back to 3DExperience and ensures that the derived neutral formats are automatically re-stamped. The most complex integration case is the exchange of change orders, because with Webasto individual parts can be changed without immediately versioning the product structure or the parts list. This only happens when the parts are installed. The integration cases must be partially readjusted, firstly because the new development environment is still under construction and secondly because the processes to be mapped are extended so that changes to the processes in 3DExperience and 4PEP occur. The flexibility of the integration platform, which allows changes or extensions to be implemented with minimal effort, has therefore proven to be an advantage, as Ortiz emphasizes: "OpenPDM is a very robust platform that has been in reliable operation since it was first launched.

In the first project phase, the new CAD and PLM solution was implemented together with the integration platform in the convertible division and tested in a pilot project, which will be followed by others. "However, everything we do here is coordinated with the other divisions, which are already working with the new systems and can contribute their experience," says Ortiz. This is important in order to standardize processes across all divisions. One of the potential hurdles that arose during the pilot project was the coordination of the product structures between the participating systems 3DExperience, 4PEP and SAP. In principle, Webasto wants to manage E- and M-BOM in 4PEP to ensure consistency between development and production. Which of the three systems, however, is to assume the leading role in the case of changes has not yet been finally clarified. It will be a compromise to ensure the strongest possible link between the systems, without limiting their flexibility too much, as Ortiz says. The pilot project also showed that the effort for data migration was greater than expected. "Existing parts and standard components lacked certain attribute information that the new systems and processes expect," says Ortiz. "Another critical topic is the handling of the kinematics functions, which are very important for the convertible division. It has changed greatly from CATIA V5 to V6, so that the changed processes had to be taken into account during the migration." Points in the direction of digitization At the end of this year, the second project phase will start with a pilot project in the field of roof systems. The biggest challenge will be to completely migrate the Windchill data to 4PEP and then to correctly link it to the CAD data via OpenPDM, which will be migrated in parallel from ENOVIA VPM to 3D Experience. A lot of information, which is represented in the form of tables on the drawings, must be transferred to the models or the PLM system. "Our goal is to no longer have drawings in PLM, but only models and information from which the representations can then be derived," concludes Ortiz. "The PLM project should help us set the course for digitization and industry 4.0." |

|

| © PROSTEP AG | ALL RIGHTS RESERVED | IMPRESSUM | DATENSCHUTZERKLÄRUNG | HIER KÖNNEN SIE DEN NEWSLETTER ABBESTELLEN. |